Create a new Excel worksheet from scratch to be used in the adjusting and tax entry process.

This course is most beneficial to tax preparers and public accountants who enter adjusting entries but is also useful to anybody in accounting. Similar Excel worksheets to the ones we will construct can be useful for analyzing many areas of accounting, and the Excel skills learned in creating them are also very applicable both inside accounting and outside of it.

We will discuss the reasons for creating an adjusting and tax entries Excel worksheet. Some benefits of the Excel worksheet include the ability to enter adjusting entries in an efficient way and build an adjusted trial balance, the ability to enter tax entries efficiently and build a trial balance on a tax basis, and the ability to reconcile book net income and tax net income.

An Excel worksheet can be used to show the difference between net income on the unadjusted trial balance, the adjusted trial balance, and tax trial balance in an easy visual way. A worksheet can be used as a reference to communicate to supervisors, clients, and as a reference for us to look back at in the future.

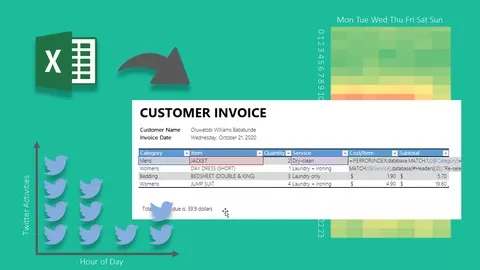

The course will build an Excel worksheet from scratch providing tools to help with the construction for each step along the way. We will provide an updated Excel worksheet for most steps, allowing us to jump forward or to rework any part of the course without starting over. The Excel worksheets will generally have at least two tabs, one with the completed step, showing the end product, and one that has been completed up to the current step in the process, allowing us to fill it in with the help of the instructional video and the Excel tab showing the completed work.

We will then practice entering some adjusting entries and tax entries into the worksheet. As we add adjusting and tax entries to the Excel worksheet, we will better understand how the worksheet is formatted and how best to use it. We will see how net income is calculated on a book basis, on a tax basis, and how the worksheet will show the reconciliation of the two.

This course is not designed to give tax advice but to show how to construct an Excel worksheet to track adjustments.

The course will also discuss some alternative formats for building an adjusting entry and tax entry worksheet that can be found in practice. We will discuss the pros and cons of the different formats.

We will also discuss how to format an adjusting and tax entry worksheet made in the prior year so that we can enter the current year trial balance and data into it.

In addition to the instructional videos, this course will include downloadable

• QuickBooks Pro Desktop 2019 Backup files

• Excel practice files

Excel Charts, Excel Analytics, Excel Pivot Table , Excel Pivot Charts, Excel Dashboard, Excel Data Analysis & Reporting

4.3

★★★★★ 4.3/5

78,407 students